Table of Contents

ToggleDesk Research

Scope

Before starting our research, we analyzed the following topics:

– financial education for children aged 6-9,

– the state of parents’ financial knowledge,

– banking in Poland

– statistical data and trends,

population statistics

– size, access to education, internet access.

What were our goals?

By conducting desk research, we wanted to find out, among other things:

- What can we do to help children aged 6-9 navigate the world of finance?

- What sources do adults use to gain financial knowledge?

- What are the characteristics of children aged 6-9 and their parents?

- What does the financial education system currently look like?

- What is the state of financial literacy among Poles?

Design problem from ING Bank Śląski

How to introduce children to the world of finance so they can learn the value of money and develop good financial habits?

Problem Context

Children sometimes receive small amounts of pocket money from family members. They often wonder, is 20 PLN a lot? What can you buy with it? Or is it better to put it in a piggy bank? Children have many questions about money… and few answers. They mostly learn about finance from their parents and grandparents, who don’t always have good financial habits to pass on.

Target Audience

Parents and children aged 6-9 who are just beginning their financial education, taking their first steps in recognizing the value of money, and managing small pocket money and irregular income from relatives.

Learn

Desk research: insights

1. Target audience characteristics

Children aged 6-9 are very diverse, but it can be assumed that they:

– enjoy playing with peers (online/offline);

– enjoy playing games, watching YouTube, using messengers;

– are influenced by their peer group;

– can use a phone/computer;

– typically own a mobile phone by age 7-10.

2. Children's education

The school curriculum leaves no time for additional financial education, so children aged 6-9 only know finance from a mathematical perspective.

3. Financial education

They rarely receive formal financial education. They mostly learn “by the way” from their parents. They know basic concepts but not the value of money. Experiential learning is a leading technique.

4. Parents' educational needs

By opening a bank account, parents mainly want to teach their child independence. They also want to have knowledge and control over their child’s online activities.

5. Banking

Most bank customers in Poland use online banking, mainly through mobile apps.

Interviews with Children: Dyads

To conduct research with children, we chose dyads (interviews in pairs). This made the children feel comfortable and willing to talk about their experiences. The presence of friends also allowed for natural interaction, providing us with additional information.

Sample: 16 children (grades 1-3).

Location: Primary School No. 4 in Rydułtowy.

The sample was selected in consultation with teachers. The biggest challenge was keeping the children focused. Interactive tasks and workshops were helpful. Surprisingly, after the research, the children saw us as authorities on finance.

Interviews with children - insights

1. Spending

Many children spend their pocket money immediately (on sweets). Those who save do so for something more expensive and know its cost. Spending can be divided into “current” and “savings goals”.

2. Needs and Influence

Most would like to learn about money. Strong peer influence. Children search visually (icons) and use familiar patterns (e.g., YouTube). They learn to count in school, not to manage money. They don’t know the best way to learn about finance.

3. Knowledge

The sight of a payment card often caused excitement. Everyone thinks saving is cool, but not everyone saves. Many children don’t know the market value of products. Money is primarily associated with coins, then banknotes.

4. Pocket Money

Associated with small sums, money from family for occasions or for doing chores. Most spend it on their needs or save for a goal.

Interviews with parents

Children’s Financial Education

Financial education is largely based on the parent-child relationship. To complement the dyads with children, we conducted individual interviews with parents to compare perspectives and gain deeper insight into the problems.

Research Method, IDI

We chose in-depth individual interviews (IDIs) conducted remotely via phone due to respondents’ busy schedules. Sample: 11 parents. The calls lasted about 40 minutes. We asked about their approach to financial education, pocket money, children’s attitude towards money, and their difficulties and concerns.

Interviews with parents – insights

1. Most parents believe a child should have their own money.

2. Most children do not receive regular pocket money.

3. Not all parents feel competent to teach children about finance.

4. Children are adept with technology but still enjoy playing outside.

5. Parents see the benefit of pocket money as a learning tool.

6. Contradictions exist: parents believe pocket money teaches money management but don’t give it because children can’t manage money.

7. Parents care about teaching savings and parental controls.

Strategy Tools

To highlight the key features of our product and create its “skeleton,” we used the following strategy tools.

Personas

1. To identify recurring patterns among the vast experiences and opinions of the participants, we started by creating personas.

Competitive Analysis

2. We then looked at the offerings of Polish competitors and international solutions. This gave us insight into the latest trends.

Value Proposition

3. We gathered the tasks and problems of the participants and, based on them, determined what our product should be.

Project Definition

4. We created a project definition summarizing the key solutions in our product and defined the Unique Selling Point.

Personas

To analyze the interviews, we used the spectrum method.

Mapping the responses allowed us to identify patterns and create:

- 2 child personas (Marek, Aneta)

- and 2 parent personas (Paweł, Beata).

We chose the primary pair (Marek-Paweł) due to their strong interest in the problem.

Primary persona - Child

Marek, 8 years old

"Money is something our parents work hard for.

You have to save and respect money."

Needs & Goals:

– wants to learn about moneywants to save for a specific goal

– wants to make his own spending decisions

– wants his own bank accountlooks for opportunities to earn his own money

Technology:

– has a phone

– types efficiently

– uses voice search

– is better with technology than his parents

Problems:

– the saving process takes too long

– lack of financial education in school

– regularly asking parents for money

– fear of online scams

Habits:

– talks to his parents about money

– saves money

– plays computer games

– plays educational games

– spends time outdoors

Secondary Persona - Child

Aneta, 9 years old

"When you save money for a long time, you get impatient because you just want to spend it."

Needs & Goals:

- saves money for a specific goal

- wants to know when she’ll get money from her parents

- needs a sense of security in managing finances

- wants to play games with friends

- wants to spend time outside

Technology:

- has an old phone from her parents

- plays on a console

- uses a computer

Problems:

- has to ask her parents for money for a long time

- worries about the safety of her money

- can’t withdraw small amounts from an ATM

- has to save for a long time for her goals

Habits:

- talks to her parents about money

- has to earn her pocket money

- saves for a specific goal

- spends time outdoors

Primary Persona – Parent

Paweł, 40 years old

"I think you need to talk about what plans children have for their money, what they are saving for."

Needs & Goals:

- wants to educate his child financially

- wants to teach his child to manage pocket money properly

- needs support in his child’s financial education

Technology:

- uses a phone and laptop daily

- feels his child is more proficient with technology

Problems:

- child has easy access to inappropriate content

- child gets addicted to technology and he has to control screen time

- doesn’t know how to educate his child financially

- wants to spend more time with his child

Habits:

- regularly talks to his child about money

- values his own personal development

- teaches his child to save and manage money

- doesn’t reward his child with money

Secondary Persona – Parent

Beata, 34 years old

"My daughter gets money. We're repeating what was done in my childhood. She doesn't get it regularly."

Needs & Goals:

- needs a tool for child education that doesn’t require a lot of time

- wants to expand her financial knowledge

- wants her child to know the value of money

Technology:

- owns a phone, laptop, and console

- her child is better with new technologies

Problems:

- worries about what her child spends money on

- unstable income

- child doesn’t know the value of money

Habits:

- only talks to her child about money while shopping

- doesn’t empower her child to make financial decisions

- doesn’t give pocket money

- doesn’t reward her child with money

Competitive Analysis – Findings

Financial education is lacking in the Polish early school system, but more companies and institutions are offering educational solutions. We took a close look at the competition. The findings helped us create our product’s Unique Selling Point.

Main findings:

1. Bank Pekao stands out with its PeoPay Kids app.

2. Financial education in schools is mainly mathematical.

3. Digital piggy banks (GoHenry, Greenlight, RoosterMoney) are popular abroad.

Value Proposition Canvas

We concluded the Learn phase by preparing a Value Proposition Canvas, which helped us better understand user needs and focus on alleviating their pain points. This allowed us to identify the key product elements to work on.

Most important solution features:

- Peer interaction feature,

- Piggy bank feature – setting and saving for goals,

- Savings app for kids – with progress tracking, leveling up, sharing with peers,

- A game where you can level up by completing finance-related tasks,

- Learning by experience – tasks to be performed offline as well,

- Holistic approach – financial education in the app, online and offline activities, contact with peers and parents, etc.,

- An app that teaches simple thinking patterns,

- “Incidental” education – daily reminders, activities that don’t take up too much time,

- A product that will guide parents on their child’s financial education.

Unique Selling Proposition & Project Definition

1. Learning through play: Combining learning with play and experience.

2. Peer interaction: Motivation to use the app, increased engagement.

3. Making mistakes: The child decides on expenses, the parent has insight and control.

4. Accessibility: No bank account required for basic functions.

5. Low entry barrier: Parents can use educational elements without creating an account.

Our app is an interactive solution for children aged 6-9 and their parents. It helps children manage their own money, provides financial education through entertainment, and allows for safe peer interaction. The app gives parents an accessible tool that comprehensively educates their child in finance and helps them achieve independence.

What did our business partner, ING, think?

Throughout the design process, we were in constant contact with our partner. Below, we describe the 3 meetings that were most valuable from our perspective:

1. Meeting with the ING Marketing Team

It helped us understand the design process of the “ING City in Roblox” game and its success factors.

2. Post-Learn consultations with university mentor

We shared our findings and learned that ING was working on a similar problem. Our insights enriched their knowledge.

3. Presentation to the ING Design Team

We presented our Learn phase process to a wider group of ING designers and researchers. The Q&A session was excellent practice for our project defense.

Design

OOUX and Use Scenarios

After the Learn phase, we knew we needed a simple, intuitive solution. We used Object-Oriented User Experience (OOUX) to understand the data structure and relationships, which made designing a coherent interface much easier. We also prepared several use scenarios to understand how users might interact with the app.

User Stories / Job Stories

We used this tool to define user needs. After an initial iteration where the stories were not detailed enough, in the second iteration we created 102 detailed stories, grouped into modules, which gave us a clear design direction.

Refining the MVP / Kano

We organized functionalities on Kano model axes. After the first iteration where most features landed in the “good” quadrants, we chose new parameters. For parents: time commitment vs. sense of security. For children: educational aspect vs. engagement.

Kano for Child

Kano for Parent

Refining the MVP / Features

And so, we included the following modules in our MVPss:

Features for the Child

- Savings Goal: Add, track, put money in physical piggy bank.

- Solo Game: Gain knowledge through missions, collect points.

- Game with a Friend: Online games, manage friends list.

- Profile: Edit avatar and nickname.

Features for the Parent

- Child Profile Management: Add profile in My ING, set time limits.

- Educational Content: Access to materials.

- Activity Monitoring: View child’s academic and savings progress.

Design Decisions

Narrowing down the scope

After defining the MVP, we realized the scope was too large for the available time. We noticed that 13 out of 40 stories related to e-banking, which would be time-consuming to prototype. We decided to discard these features, treating them as a future development direction, to focus on other forms of financial education.

32%

– is by how much we reduced the number of user and job stories in our MVP.

Design Transformation

Finding a consistent style was a process of exploration. We had to set aside our personal preferences for the children’s. After analyzing existing games, we arrived at the final look, which was to be validated during testing.

1. Sketch

→

↓

2. Wireframe

→

↓

3. Prototype

Design: First Iteration

Finding a consistent style was a process of exploration. We had to set aside our personal preferences for the children’s. After analyzing existing games, we arrived at the final look, which was to be validated during testing.

Key Features: Savings

A section where the child can add savings goals, deciding how much, how often, and for what purpose they want to save, with the help of a built-in calculator. It connects cash with technology. The child receives notifications and marks tasks as complete in the app.

Key Features: Solo Mission

The game offers the ability to level up by solving finance-related tasks, developing simple thinking patterns. Some tasks are performed outside the app, enabling learning through practical experience.

Key Features: Multiplayer Game

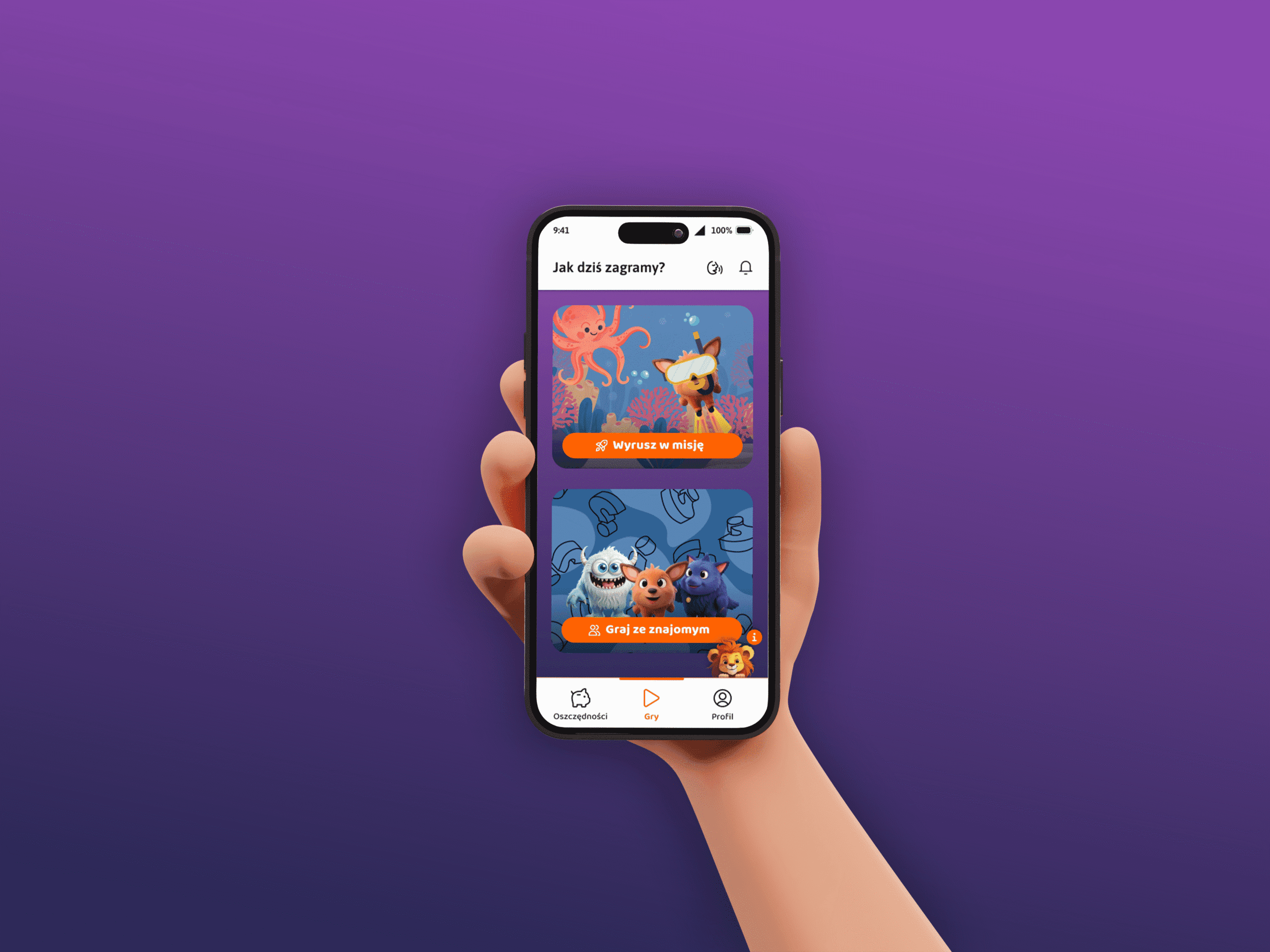

Children can play together with their peers. We designed the game selection and friend invitation process. The games themselves are beyond the scope of our work.

Features dedicated to children with reading difficulties or lack of confidence. We minimized text, and additional information is available from an interactive helper.

1. Read aloud: Reads the screen content aloud, highlighting the text.

2. Leo the helper: An interactive assistant that becomes active during inactivity and offers help by speaking aloud.

Key Features for Parents

A new feature in the My ING app that supports financial education. The parent adds the child’s educational profile to access materials and track their academic and savings progress.

1. Access to educational materials: Easily accessible, low-time-commitment materials. Suggestions based on the child’s results.

2. Activity and achievement monitoring: Dashboard with insight into the child’s activity and results.

Measure

Usability Testing

Goal: To improve the usability of our solution by analyzing user reactions and to verify interest in the solution.

Method: Moderated usability testing with a think-aloud protocol.

Sample Selection: We re-contacted participants from the Learn phase (6 children, 4 parents) who represented our personas.

Procedure: All sessions were conducted in person (at school with children, at home with parents). A moderator and an observer were present, and everything was recorded.

Usability Testing – Main Findings

For Children

“A solo mission? So like some mission? (…) like you go to the mountains?”

- Problems reading texts (too small).

- The read-aloud feature (speaker icon) was not noticed.

- Misunderstanding of main screen graphics (taken literally)

For Parents

“I’m interested in knowing what the child doesn’t know.”

- They want to know what the child has learned to talk about it with them.

- They expected saving for a goal to be handled via e-banking.

- They don’t want the app to allow adding photos from the gallery for security reasons.

Solo Game – Mission

Decisions: Combined the avatar with the mission start button. Changed the mission screen to a map zoom with a side menu. Replaced the progress bar with coins. Flattened the hierarchy (no levels or avatar changes). Moved the mission list to the parent’s profile.

Before

After

Savings Goals

Decisions: Enlarged text in the helper bubble, reduced overall text, changed the read-aloud icon, and updated main screen graphics to be more contextual.

Before

After

Multiplayer Game

Decisions: Displayed active friends on the game selection screen. Added missing game screens and descriptions. Added icons to buttons and shortened texts. Changed the confusing quiz graphic.

Before

After

Child's Profile in Parent's App

Decisions: Avatar editing is possible by clicking on it. Expanded avatar customization without adding personal photos. The avatar updates in real-time.

Before

After

Design: Second iteration - Solution for Kids

Solution for Children

The prototype can be viewed in its entirety or by sections: Registration, Onboarding, Solo Game, Game with a Friend, Savings, Profile.

Design: Second iteration - Solution for Kids

Solution for Parents

ING App, Page on the ING website.

Recommendations for future development

1. Consultation with experts

Continuous collaboration with experts (educators, finance experts, psychologists, game designers) will be key. Children need frequent updates to content and games. We suggest developing a points system for in-app purchases.

2. Development of educational content for parents

We recommend expanding content for parents in My ING and on the website. Materials should be varied (text, video, quizzes, workshops) to meet diverse needs.

3. Continuous functionality improvements

We recommend iterative development, especially after introducing e-banking features. Further usability testing and changes will be necessary.

4. E-banking in the children's app

We envision creating an e-banking section with features like simplified accounts, pocket money transfers, BLIK/card/phone payments, online payments, transfer requests, and card customization.

5. Complementary features in the parent's app

This will require updating the parent’s section in My ING: parental controls, spending limits, automatic pocket money, quick transfers.

6. Security

New banking features require enhanced security: an additional password, fingerprint login, secure pairing, and account/card blocking functions.

“If I were making a transfer, I would then take a look at what Marek is up to in the app”

– Parent, quote from user research

Project work distribution

We met regularly, totaling over 150 hours of group calls and countless hours of individual asynchronous work. We exchanged over 270 comments in Figma and discussed the project almost daily on chat.

Learn phase

Dyads: Ania and Asia. Desk research and competitive analysis: Monika and Borys. The entire team participated in the remaining parts.

Design phase

Initially, we worked together, then each took a part of the prototype:

- Solo game & onboarding – Asia,

- Multiplayer game – Borys,

- Savings – Ania,

- Profile & parent’s offer – Monika.

Measure phase

- Usability testing: Monika and Ania.

- Transcriptions: Borys and Asia.

We analyzed the usability testing together and implemented improvements according to the Design phase division.

Designers behind the project

BK

B. Kapica

MA

M. Andrzejczak

JJ

J. Jakab

AK

A. Kolbusz

Thank you for viewing this case study.

Feel free to view my other projects and get in touch!